Reduce your annual property tax exposure & mitigate penalties, interest, and over-taxation.

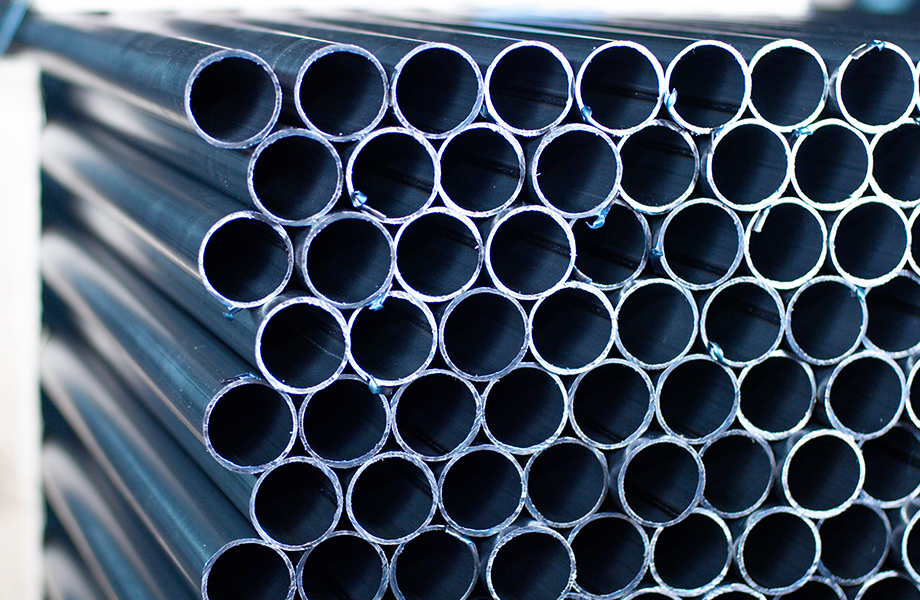

Don't let the convoluted process of valuing your oil and gas properties lead to over-taxation.

Identifying all available opportunities to save your company money is essential in ensuring your business's stability and success. Unfortunately, most business leaders don't have the time or tax team needed to execute the overwhelming process of researching and pursuing all opportunities available for minimizing your property tax liabilities.

Here's how your 360° Property Tax Consultation helps you.

Reveals whether or not your business is eligible for tax incentives.

Uncovers how your inventory movement can affect your due property tax liabilities.

Identify how you can reduce your annual property tax exposure.

Don't pay more than your fair share of property taxes.

1. Request free 360° property tax consultation.

Submit principal contact details to request a meeting with a property tax expert.

2. Connect with your property tax consultant.

Submit relevant business details, documents, and inventory location to identify available opportunities.

3. Save money on your property tax liabilities.

Sign-up and capitalize on our proprietary Trendulation™ business process and save on your property tax liabilities.

The truth is most business leaders are overpaying on their property taxes.

Most business leaders don't have the time or tax team needed to execute the overwhelming process of identifying and pursuing all opportunities for minimizing their industrial property tax liabilities.

At J. Joseph, each year, our proprietary Trendulation™ business process helps save our clients millions in overlooked property tax savings. You deserve the power of a proven process and a team of multi-disciplined property tax agents to ensure you capitalize on all property tax savings available to your business.

Request your free 360° property tax consultation now and reduce your annual property tax exposure & mitigate penalties, and interest, and avoid over-taxation.