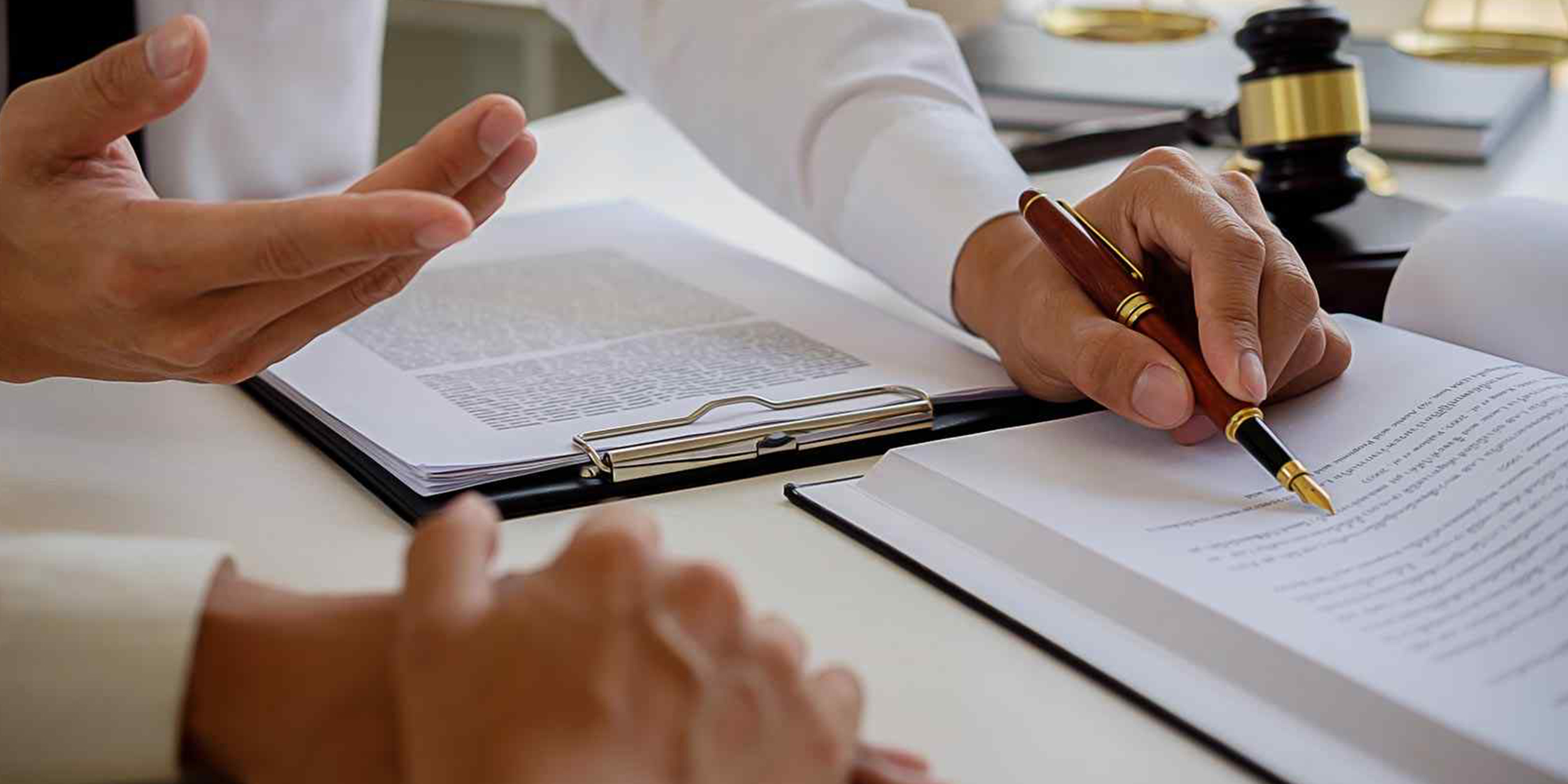

Identify all opportunities to minimize your property tax liabilities.

Saving millions in overlooked property tax savings each year, our experts exhaust every avenue to reduce your property tax liabilities. Submit your free Property Tax Analysis to identify if your business is eligible for a property tax reduction.

We Help You

Compliance

Ensure you are meeting all deadlines, state requirements, and mandates.

Consulting

Improve performance through objective strategies, expert opinions, analysis, and business recommendations.

Recovery

Identify any overlooked savings and take any advantage to go back retroactively to recover those assets.

Advocacy

Our team of compassionate advocates strives to advocate, strengthen, counsel, and intercede when necessary.

At J. Joseph, It’s Not Just About Metrics And Savings; It’s About Relationships.

Rio Energy

Here's how your 360° Property Tax Consultation helps you.

Reveals whether or not your business is eligible for tax incentives.

Uncovers how your inventory movement can affect your due property tax liabilities.

Identify how you can reduce your annual property tax exposure.

AdVolution® & Trendulation®

Maximize your company’s property tax compliance needs with AdVolution®, J. Joseph’s proprietary & cutting-edge strategic compliance service. AdVolution® was developed in-house by our team of analysts, property tax advisors, and subject matter experts. AdVolution® ensures your returns are filed accurately and in compliance with all jurisdictions nationwide. With detailed reporting to track appeals and results, AdVolution® is the perfect tool to enhance your company’s tax mitigation strategy. Along with our proprietary reporting summary, Trendulation® , we leverage our comprehensive analysis to uncover all possible strategies to potentially reduce your tax liabilities. These services provide you with a complete 360° understanding of your results and summarize your savings and tax liabilities.

Stay Informed and In Control

3 Critical Questions Your Property Tax Consultant Must Be Asking

Leave no stone unturned & identify opportunities to reduce your business's property tax liabilities.